|

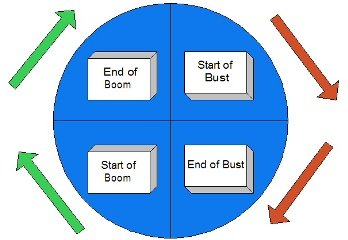

How to benifit from real estate cycles for long term investors?If you want to protect and take advantage from real estate cycles, then you should learn each cycle's key characteristics. The beauty of property is that real estate cycles are based on geographic locations. It's different in every country, city, and state. For example, house prices may be higher in where you live, but drive around 20- 30 km from here and you'll see lower prices in that neighborhood. To invest profitably in the real estate market means you have to know the cycle history in that area. Generally, real estate cycles are based on 4 phases illustrated below:

a)Start of boom This phase is also where people are coming in because of good job prospects, better standard of living and have access to nice amenities and facilities. Rents also rise to market levels due to shortages of rental properties and high demand of tenants. As a result, vacancy rates are coming down. If there are shortages of properties, developers start noticing and begin construction of new houses or apartments to meet growing demand. Unfortunately greed comes in the form of speculators, beginning investors, and home buyers all trying to take advantage of the "perceived" boom. On the contrary, experienced investors are beginning to exit the market as they know this boom will not last. When prices are so high, most people cannot afford to purchase because their income levels are not growing at the same pace as the property market. Worse still, there are too much newly built homes and apartments. Eventually, it can cause an oversupply to the market. People who cannot afford high monthly payments begin to default by losing their homes through foreclosures. Others are selling at a loss due to fear. This can cause rents to drop and vacancy rates to rise as people are either moving back to their families and relatives or renting at cheaper places elsewhere. Banks are also starting to tighten their lending policies and also increasing interest rates, thereby discouraging borrowers from getting the loan they need. Demand starts coming back, but not as much as in the boom phase. Rents are starting to rise slowly due to more people renting than buying. Why it is cheaper to rent? Even though house prices drop to a reasonable level, interest rates at this time is still high, thereby discouraging most borrowers. Meanwhile, there are still sellers wanting to dispose their properties as they think prices will continue to fall. a)Employment High employment means there are more jobs in an area which tends to allow people to afford buying or renting homes. Shopping malls, small or large businesses can provide jobs, thereby increasing property prices in that area. b)Interest Rates Real estate cycles are disrupted by government raising or lowering interest rates. When there is an increase in interest rates, property growth slows. This is because people are getting difficulty in borrowing funds from banks due to high interest. Conversely when interest rates is low, banks are willing to finance buyers which will result in the increase in property prices. c)Population The number of people coming into an area because of better job prospects, good facilities and amenities can increase real estate prices in that particular area. d)People's attitude towards the market Real estate cycles are sensitive to market sentiments. Situations such as politics, recession, or terrorism can negatively affect real estate cycles. e)Rents In a boom phase, rent rises due to increased demand. Conversely, when there are too much rental homes or less people renting, it drops. Rents tend to go up or down with real estate prices. f)Incomes People with high income levels can afford to buy more expensive properties. Home prices increase when affordability is high. g)Constructions High level of construction in an area usually means there are more demands for properties, which drives prices up. But if too much construction is going on while the demand is at the same level, eventually there will be an oversupply of properties, pushing prices down. h)Bank willingness to finance Banks are in the business of lending. During the boom phase, many banks tend to compete by lowering interest rates to encourage investors and home buyers borrow to finance their properties. However when it comes to the bust phase, financing becomes difficult as banks are reluctant to lend, charging high interest rates and tighter requirements for those who are willing to obtain finance. i)Changes in laws Laws in every state or city is different and this can affect real estate cycles independently in each city. As laws can change from time to time, it is important to pay attention to them. Become a contrarion investor, meaning that when others are selling, you buy. There are several reasons for buying in a down cycle: a)It's a seller's market, which means people are trying to sell their properties below market value since less people are buying. Remember, when supply exceed demand, prices fall. b)Although people are selling and home prices are falling, they still need to live somewhere. That means demand for rental properties is still around. c)In addition to falling home prices, you can negotiate with sellers for more reduction. d)Home prices falling until it is in tandem with peoples income, making it affordable to buy again. This starts the next buyer's market(boom phase). |